Executive remuneration policy

The policy report sets out the remuneration policy (the "Policy") that the Company intends to apply, subject to shareholder approval, with effect from 29 July 2014 (the date of the AGM). It is intended that this Policy will apply until the 2017 AGM, unless the Company seeks shareholder approval for a revised policy which comes into force before this date.

The Committee seeks to support the delivery of the Group's strategy through establishing appropriate remuneration arrangements. Our goal is to build a strong long-term sustainable business by delivering ongoing sales growth and sustainable shareholder returns through the delivery of authoritative ranges of products, colleague and service excellence, digital participation and helpful store and Autocentre environments.

Consequently, the overall remuneration policy of the Committee, and of the Board, is to provide remuneration packages for Executive Directors and other senior managers in the Group which:

- Attract and retain — Enable the Group to attract and retain management of a high calibre with the necessary retail, customer service, financial, digital and service-industry skills and credentials required to deliver a sustainable business model and drive shareholder returns. Remuneration arrangements are set at levels appropriate to achieving this goal without paying more than is considered necessary. Benchmarking exercises are undertaken at appropriate intervals to inform the positioning of executives' pay relative to the market and, without seeking to "match the median", to identify and mitigate the risk of losing strong performers.

- Link variable pay to performance and the delivery of the agreed strategy — Provide management with the opportunity to earn competitive remuneration through annual and long-term variable pay arrangements that are designed to support delivery against key strategic objectives. Performance measures are aligned with strategic goals so that remuneration arrangements are transparent to executives, shareholders and other stakeholders. Different elements of executive pay are delivered over the short and longer term and are designed to ensure that a substantial proportion of the executives' remuneration is variable and performance-related.

- Align executives as shareholders — Ensure management's interests are aligned with those of shareholders by incentivising management to deliver the Group's long-term strategy of a sustainable, growing business and thus enhance shareholder value. A significant portion of reward is delivered in shares to create alignment of interests.

- Drive sustainable performance — Remuneration arrangements are designed to support the sustainable delivery of performance and to prevent excessive risk taking.

Enhanced displays and, in selected stores, the ability to try pressure washers.

Key elements of executive remuneration policy

| Base Salary | |

|---|

Purpose and link to strategy

Base salary, which is payable in cash, is set at an appropriate level to attract and retain management of a high calibre with the necessary retail, customer service, financial, digital and service-industry skills and credentials required to deliver a sustainable business model and drive shareholder returns. |

| Operation | Maximum Opportunity |

Generally salaries are reviewed annually with increases effective from 1 October but may be reviewed at other times if the Committee considers this appropriate.

In determining base salary levels consideration is given to the individual's experience and the performance of the Group and the individual. Without seeking to "match the median" consideration is also given:

- To salary levels at other companies of a similar size and complexity;

- To salary levels at other UK listed retailers; and

- To pay increases for other employees in the Group.

| While there is no maximum salary level, salary increases will generally be in line with increases awarded to other employees in the Group.

However, larger increases may be made at the discretion of the Committee to take into account circumstances such as:

Changes in an individual's role or responsibility;

To reflect an individual's progression and increase in experience in the role;

Where a salary is significantly behind market practice. |

| Performance Measures |

| The payment of salary is not subject to performance conditions. However, when determining salary levels the performance of Executive Directors is taken into account, in advance of any increases being awarded. |

Download the PDF document for Base Salary.

| Benefits | |

|---|

Purpose and link to strategy

To provide Executive Directors with market competitive benefits consistent with the role. |

| Operation | Maximum Opportunity |

The Committee's policy is to set benefits at an appropriate level taking into account the individual's circumstances and market practice.

Currently, base salary for Executive Directors is supplemented with a car plus fuel or a cash allowance, private health insurance and life assurance as standard benefits.

However, the Committee may determine that additional benefits may be provided based on individual circumstances, such as the use of a chauffeur when it is considered appropriate.

In the event that an executive is required to re-locate to perform their role then additional benefits may be provided such as relocation expenses, a housing allowance and school fees.

Executives are also eligible to participate in any all-employee share plans operated by the Company on the same basis as other employees. | The overall level of benefits will depend on the cost of providing individual items and the individual's circumstances and therefore there is no maximum level of benefit. |

| Performance Measures |

| None |

Download the PDF document for Directors Benefits.

| Pensions | |

|---|

Purpose and link to strategy

To enable the Company to offer market competitive remuneration through the provision of additional retirement benefits. |

| Operation | Maximum Opportunity |

Defined employer contribution funding to the Halfords Pension Plan or payments into a personal fund up to the earnings cap as set by HMRC. Pension provisions above this level are made in the form of a cash allowance.

The Committee may determine that alternative arrangements should apply (including for new hires). When determining such arrangements the Committee will consider cost and market practice (subject to the overall limit set out in the maximum column). | The annual contribution for each individual will not exceed 20% of base salary. Currently the CEO receives 20% of base salary, whilst the Chief Financial Officer ("CFO") receives 15% of base salary. |

| Performance Measures |

| None |

Download the PDF document for Pensions.

| Annual Bonus | |

|---|

Purpose and link to strategy

To incentivise executives to achieve annual financial targets and performance against key strategic objectives. The Committee may determine that an Executive Director may be required to defer some or all of their annual bonus into shares under the Company's Deferred Bonus Plan to further incentivise them to manage risk and align their long-term interests with those of shareholders. |

| Operation | Maximum Opportunity |

The annual bonus is normally based on performance over a financial year.

The Committee determines after the year end the extent to which targets have been met. In certain circumstances the Committee may review the annual bonus payout in the context of the performance of the business during the year and the delivery against strategy and may amend the level of bonus payout (upwards or downwards) to reflect overall business and individual performance.

Generally the annual bonus is paid in cash, but in certain circumstances the bonus may be paid in shares or in a mixture of cash and shares as determined by the Committee.

Currently the CEO must defer 1/3 of any bonus earned into an award over shares under the Deferred Bonus Plan. However, the Committee may determine that a different portion of the bonus will be paid in shares or that the bonus may be paid in cash.

Deferred bonus awards are normally made in the form of nil cost options (but may be in other forms such as a conditional award). Deferred awards normally vest three years from award (or such other period as the Committee determines) and have no additional performance conditions.

Executives may, at the Committee's discretion, receive an amount (in cash or shares) representing the dividends paid between the date of grant and the exercise of the award in respect of the number of deferred shares vesting. The Committee shall have the discretion to determine how the value of this dividend award shall be calculated, which may include the deemed reinvestment of dividends in shares on a cumulative basis.

Deferred awards vest three years after the date of the award. The Executive will also receive an amount in cash or in shares representing the dividends paid between the date of the grant and the exercise of the award in respect of the number of shares vesting. This will include the deemed reinvestment of dividends in shares on a cumulative basis.

For deferred shares granted from 2014 onwards the Committee may determine that the number of deferred bonus shares can be scaled back before exercise in the event of a material misstatement of the Company's results, or where the Company has suffered serious loss or reputational damage in respect of the period for which the Executive had responsibilities for the running of the business.

Bonuses are non-pensionable. | The maximum annual bonus opportunity is 150% of base salary.

The current individual limits are outlined below:

- CEO: Maximum annual award 150% of base salary.

- CFO: Maximum annual award 100% of base salary.

|

| Performance Measures |

The annual bonus targets are based on a mix of financial and strategic measures. Measures are selected each year by the Committee to ensure continued focus on the Company's strategy. At least 50% of the bonus will be based on financial measures.

Performance measures are set annually to ensure they are appropriately stretching for the delivery of threshold, target and maximum performance.

For 2014/15, the bonus will be based on performance against PBT and strategic objectives consistent with the Getting into Gear strategy.

Further details are provided in the Annual Remuneration Report.

No bonus will be paid for below threshold performance and 100% of bonus will be paid for achieving a stretching performance target set by the Remuneration Committee with reference to prior year performance and the Group's business plan. |

Download the PDF document for Annual Bonus.

| Performance Share Plan | |

|---|

Purpose and link to strategy

To attract and retain Executive Directors of a high calibre. To align Executive Directors' interests with those of our shareholders by incentivising them to deliver the Company strategy and to create a sustainable business and maximise returns to shareholders. |

| Operation | Maximum Opportunity |

Annual awards of shares with vesting based on performance over a three-year period (or such other period as the Committee shall determine). The awards are normally made in the form of a nil-cost option award (but may be made in other forms such as conditional shares awards or jointly owned equity) and the vesting of awards to Executive Directors is subject to the satisfaction of performance conditions.

To the extent that awards granted from 2013 onwards vest in line with the Performance Multiplier (as defined in the next column) these share awards will normally only become exercisable following a retention period of two years (unless the Committee determines otherwise) from the point at which the Committee determined that the performance conditions have been met.

Executives may, at the Committee's discretion, receive an amount (in cash or shares) representing the dividends paid between the date of grant and the exercise of the award in respect of the number of shares which have vested. The Committee shall have the discretion to determine how the value of this dividend award shall be calculated, which may include the deemed reinvestment of dividends in shares on a cumulative basis.

The Committee may reduce, or impose further conditions on, an award which is subject to a holding period in circumstances where the Committee considers it appropriate such as the material misstatement of the Company's results, serious reputational damage to the Company or where the company suffers serious losses. | Maximum core award 150% of base salary.

Participants have the opportunity to earn up to 1.5 × core award for exceptional performance (the "Performance Multiplier").

The maximum annual face value of awards is therefore 225% of base salary. |

| Performance Measures |

For 2014 awards will vest subject to the achievement of stretching Revenue and EBITDA targets.

The vesting of 25% of the awards will be determined by the growth in the Group's revenue and the vesting of 75% of the award will be determined by the growth in the Group's EBITDA over a three-year performance period.

In addition to achieving these targets, the vesting of awards will be subject to meeting a net debt underpin to ensure that debt remains at appropriate levels and that management are not incentivised to deliver revenue growth at the expense of profitability.

The portion of the award that can be earned in relation to the revenue portion will be limited by the extent to which EBITDA targets are met.

30% of the award vests for entry level performance.

For details of performance conditions for awards granted in 2011, 2012 and 2013 see notes to the table.

For future awards the Committee may determine that different financial, operational or share price related performance measures may apply to awards or that a different weighting between performance measures may apply to ensure continued alignment with our evolving strategy. The majority of the award will be subject to meeting a financial performance target. |

Download the PDF document for Performance Share plan.

| CEO Co-Investment Award | |

|---|

Purpose and link to strategy

The award was implemented in October 2012 as a one-off incentive to recruit and retain a high-calibre CEO, to align his interests with those of our shareholders, and to reward growth in share price. No further awards will be made under this plan. |

| Operation | Maximum Opportunity |

A one-off award made on the appointment of the CEO. The CEO was required to invest £500,000 in Halfords shares ("investment shares") to receive a matching share award.

If the CEO disposes of these investment shares during the matching share performance period, then the matching shares shall lapse to the extent the investment shares have been disposed.

The CEO was granted an award of matching shares in the form of a nil cost option that may vest in tranches following the Committee's assessment of performance (see performance measures column).

Prior to vesting the Committee will satisfy themselves that the achievement of the share price targets is a genuine reflection of the Company's underlying financial performance and may adjust the level of vesting accordingly.

The Committee may determine that the number of matching shares can be scaled back before exercise in circumstances that the Committee determines are appropriate such as a material misstatement of the Company's results, serious reputational damage to the Company, or where the Company suffers serious losses.

The CEO may, at the Committee's discretion, receive an amount (in cash or shares) representing the dividends paid between the date of grant and the exercise of the award in respect of the number of shares which vest. The value of this dividend award shall be calculated based on the deemed reinvestment of dividends in shares on a cumulative basis. | The maximum number of matching shares which may be acquired under the award (excluding dividend equivalents) is 3.5 times the number of investment shares acquired. The CEO acquired 164,056 at a price of 302.22p. |

| Performance Measures |

Share price performance targets for November 2015, November 2016 and November 2017.

Share price performance will be assessed using the average mid-market closing share price for the 30 days following the announcement of the Interim results for the relevant year (normally November).

At each relevant vesting date the CEO may decide to either exercise any portion of the award that has vested based on performance at that time (in which case any unvested shares in that tranche in respect of which the share price target has not been met will lapse) or roll forward that tranche in full to be subject to performance testing at the next vesting date. In the latter case ("roll-forward") the Participant will forfeit the right to exercise any awards that had become capable of vesting at the earlier vesting date.

30% of the award vests for achieving threshold performance.

For further details of the operation and targets please see the Annual Remuneration Report. |

Download the PDF document for CEO Co-Investment Award.

Space to assess and consider premium cycles.

Other information

2011 And 2012 psp awards performance condition

Awards made under the PSP in 2011 and 2012 vest subject to the achievement of stretching TSR and EPS targets. The vesting of 50% of the awards will be determined by the Group's relative Total Shareholder Return ("TSR") performance when measured against a general retailers' comparator group chosen from the FTSE 350. The vesting of the other 50% will be determined by the Group's absolute Earnings per Share ("EPS") growth performance compared against RPI over the performance period.

Shareholding guidelines

The Committee believes that it is important that Executive Directors' interests are aligned with those of our shareholders to incentivise them to deliver the corporate strategy, thus creating value for all shareholders. Executive Directors are encouraged to acquire and retain shares with a value equal to 100% of their annual base salary. Executive Directors have a five-year period to build this shareholding following their appointment. However, the Committee retains its discretion to extend this period in instances it considers such extension appropriate. Current Executive Director shareholdings are disclosed in the Annual Remuneration Report.

Legacy awards

The Committee reserves the right to make any remuneration payments and payments for loss of office (including the exercise of any discretions available to it in connection with such payments) notwithstanding that they are not in line with the Policy set out above where the terms of the payment were agreed (i) before the Policy came into effect or (ii) at a time when the relevant individual was not a director of the Company and, in the opinion of the Committee, the payment was not in consideration for the individual becoming a director of the Company. For these purposes "payments" includes the Committee satisfying awards of variable remuneration and an award over shares is "agreed" at the time the award is granted.

Minor amendments

The Committee may however make minor amendments to the policy set out above (for regulatory, exchange control, tax or administrative purposes or to take account of a change in legislation) without obtaining shareholder approval for that amendment.

Plan rules

Awards under the Deferred Bonus Plan, Performance Share Plan and Co-Investment Award will be operated in accordance with the rules of the plans. In the event of a variation of the Company's share capital or a demerger, delisting, special dividend, rights issue or other event, which may, in the Committee's opinion, impact the value of awards, the terms of awards may be adjusted. In addition, the Committee may amend an award's performance conditions where an event occurs which causes the Committee to reasonably consider that an amended performance condition would be, in the case of the PSP, a fairer measure of performance and a more effective incentive and, in the case of the Co-Investment Award, more appropriate and not be materially less difficult to satisfy. The rules may be amended in accordance with their terms.

Cash

Awards may be settled in cash at the discretion of the Committee.

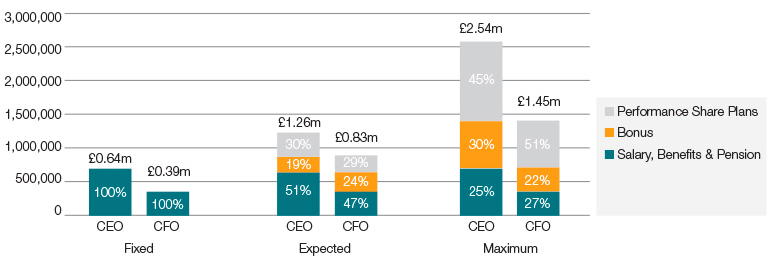

Remuneration arrangements in different performance scenarios

As outlined above, the remuneration policy is designed to ensure that a substantial proportion of the Executive Directors' remuneration is variable and performance-related. By linking the remuneration of the individual Executive Director to the performance of the Company, the Committee seeks, as far as possible, to motivate that individual towards superior business performance and shareholder value creation, and to only pay rewards when these goals have been realised. Performance measures are aligned with strategic goals so that remuneration arrangements are transparent to Directors, shareholders and other stakeholders.

The charts below illustrate remuneration arrangements in different performance scenarios. The assumptions for each scenario are outlined below:

| Fixed Pay | - Fixed pay (base salary, benefits and pension) only

|

| Expected | |

| - On target annual bonus opportunity

|

| - 50% of core PSP award (75% of salary)

|

| Maximum | |

| - 100% of maximum annual bonus opportunity

|

| - 1.5× the core PSP award (225% of salary)

|

The one-off CEO Co-Investment award has not been included in the scenario chart as there is no intention to grant further awards.

| Executive Director | Base Salary with effect from

1 October 2013 | Benefits Single Figure Value for 2013/14 | Pension Based on Salary with effect from

1 October 2013 | Total Fixed Remuneration |

|---|

| Matt Davies (CEO) | £507,500 | £31,212 | £101,500 | £640,212 |

| Andrew Findlay (CFO) | £325,000 | £17,050 | £48,750 | £390,800 |

The above scenarios do not take into account share price growth and any additional dividends that may be earned are not taken into account.

Performance conditions

Annual bonus: The bonus is subject to a mix of financial and strategic measures. These measures are selected to provide an appropriate balance between profitability and strategic objectives and to incentivise individual directors to meet corporate targets and drive individual performance. Targets are set on an annual basis taking into account internal and external expectations of performance.

Performance Share Plan: The performance measures for 2014 awards are Group Revenue and EBITDA growth. Revenue growth is a clear reaction to the Getting Into Gear 2016 programme and is easily identified by both management and shareholders. However, in order to add value for shareholders, revenue improvements need to lead through to improved profitability. The majority of the PSP award is therefore subject to improved profit performance. Growth in EBITDA is a measure of operational profit performance and operational cash management, with a clear line of sight for management. Given the evolution in strategy and the consequent focus on investment for long term shareholder value, EBITDA is a more appropriate measure of the effective delivery of the strategy. At the same time, to ensure a continued focus on cash management a target/underpin of net debt/EBITDA has been introduced. Targets are set taking into account internal and external expectations of performance.

The Committee may determine that different performance measures will apply to future PSP awards.

Recruitment remuneration policy

When hiring a new Executive Director, it would be expected that the structure and quantum of the variable pay elements would reflect those set out in the policy table above. However, at recruitment, the Committee would retain the discretion to flex the balance between annual and long-term incentives and the measures used to assess performance for these elements, with the intention that a significant proportion would be delivered in shares subject and that variable pay would be subject to performance conditions. In all cases the value of any variable pay that will be granted in respect of an executive's recruitment (excluding any buyout compensation for the 'loss' of existing variable remuneration benefits) will be a maximum of 375% of annual salary.

The Committee may also make arrangements to compensate the new executive for 'loss' of existing remuneration when leaving a previous employer. In doing so the Committee may take account of the form in which they were granted; any relevant performance conditions; the length of time that any relevant performance periods have to run; and the organisation which previously employed the Executive. The Committee will seek to deliver buy-out arrangements on a broadly like for like basis to those forfeited.

When determining salary levels for a new Executive Director, the Committee may set the initial salary level towards the lower end of market practice and may award higher salary increases in the first few years as the individual gains in experience to move them towards a more market normal level.

To facilitate buy-out awards outlined above, in the event of recruitment, the Committee may grant awards to a new Executive Director under the Listing Rule 9.4.2 which allows for the granting of awards to facilitate, in unusual circumstances, the recruitment of an Executive Director without seeking prior shareholder approval or under other relevant Company incentive plans.

In the event that an internal candidate was promoted to the Board legacy terms and conditions would normally be honoured, including pension entitlements and any outstanding incentive awards.

Remuneration arrangements elsewhere in the group

Whilst our remuneration policy follows the same principles across the Group, remuneration packages for colleagues reflect their different roles and experiences, and market practice for similar roles.

The remuneration policy for senior executives in the Group is similar to the policy for Executive Directors as set out in this report - a substantial proportion of remuneration is performance related in order to encourage and reward superior business performance and shareholder returns and remuneration is linked to both individual and Company performance. Basic salary is targeted at normal commercial rates for comparable roles and is benchmarked on a regular basis. Bonuses can be earned on the same basis as the Executive Directors. Senior Executives immediately below Board level also benefit from participation in the PSP.

Increases to executive managers' base salaries are considered at the same time as all other colleagues across the Group and increases are generally in line with all colleagues.

All of the Group's c.12,000 colleagues are eligible to join the Halfords Sharesave Plan (SAYE) after they have served one complete month's service. At the same time they are all eligible for some form of quarterly or full year bonus, although the type, limits and performance conditions vary according to job level. Senior managers and other key management individuals are invited to join the Company Share Option Scheme.

In 2013/14 all newly appointed colleagues and other existing colleagues who had experienced a 'joining-trigger' event were eligible to join the Halfords Pension Plan 2009. All members of the Pension Plan are required to make a minimum contribution of 3% and the Company also contributes a minimum of 3%, dependent on length of service and seniority. During the year the Company has met its obligations under the pensions auto enrolment legislation, auto enrolling all other colleagues as appropriate.

Executive directors' service agreements

Term and notice periods

The Company's policy in relation to contractual terms on termination, and any payments made, is that they should be fair to the individual, the Company and shareholders. Failure should not be rewarded and the departing Executive's duty to mitigate any loss he suffers should be recognised. The Committee periodically reviews the Group's policy on the duration of Executive Directors' service agreements, and the notice periods and termination provisions contained in those agreements. The Company is aware that companies are encouraged to consider notice periods of less than 12 months, and in contracting with the CEO it was agreed that a notice period of six months was appropriate. The notice periods of the other Executive Directors remains limited to 12 months. The Committee policy is that notice period for new Executive Directors will be no more than 12 months. The Committee will continue to review this policy, to ensure that it remains in line with the Company's overall remuneration policy

| Date of Service Agreement | Notice

Period |

|---|

| Matthew Davies | 4 October 2012 | 6 months |

| Andrew Findlay1 | 16 November

2010 | 12 months |

| Paul McClenaghan2 | 9 May 2005 | 12 months |

- Andrew Findlay was appointed to the Board on 1 February 2011 and his service agreement was effective from that date.

- Paul McClenaghan resigned on 12 April 2013.

Termination of contract

No compensation would be payable if a service contract were to be terminated by notice from an Executive Director or for lawful termination by the Company (other than as set out below). The Company may terminate service agreements in accordance with the appropriate notice periods. In the event of early termination (other than for a reason justifying summary termination in accordance with the terms of the service agreement) the Company may (but is not obliged to) pay to the Executive Director, in lieu of notice, a sum equal to the Executive Director's then salary, benefits and pension contributions, which he would have received during the contractual notice period (12 months for the CFO and six months for the CEO), the sum of which shall normally be payable in monthly instalments.

Executive Directors who are considered to be good leavers may, if the Committee determines, receive a bonus for the financial year in which they leave employment. Such bonus will normally be calculated on a pro rata basis by reference to their period of service in the financial period in which their employment is terminated and performance against targets.

Mitigation on termination

Where a contract has been terminated early the Executive Director shall use their best endeavours to secure an alternative source of remuneration, thus mitigating any loss to the Company, and shall provide the Board with evidence of such endeavours upon their reasonable request. If the Executive Director fails to provide such evidence the Board may cease all further payments of compensation. To the extent that the Executive Director receives any sums as a result of alternative employment or provision of services while he is receiving such payments from the Company, the payments may be reduced by the amount of such sums. In good leaver circumstances the Executive Director might be offered a lump sum termination payment paid at the time they cease employment which would normally be less than he would receive if he were to be paid his annual salary and benefits over 12 months (six months for the CEO).

Change of control

The service agreements of Executive Directors do not provide for any enhanced payments in the event of a change of control of the Company.

The Executive Directors' services contracts are available for inspection by shareholders at the Company's registered office.

Share plans – leaver treatment

The treatment of outstanding share awards in the event that an Executive Director ceases to hold office or employment with the Group of the Company's associated companies is governed by the relevant share plan rules. The following table summarises leaver provisions under the executive share plans.

| 'Good leavers' as determined

by the Committee | Leavers in other circumstances

(other than gross misconduct) |

|---|

| Halfords Performance Share Plan | | |

| Under the PSP "Good Leavers" include: Death, injury, ill-health disability, redundancy, retirement, sale of the individual's employing business or company out of the Group or to a company which is not associated with the Company or in any other circumstances the Committee determines. | Awards may vest at the end of the performance period or if a retention period applies at the end of the retention period. The Committee will determine the level of vesting having due regarding to the extent to which the performance conditions have been met and unless the Committee determines otherwise the proportion of the performance period that had elapsed at leaving.

Alternatively the Committee may determine that awards should vest at the time of leaving on the basis set out above.

The Executive has 12 months from vesting (or if later, his date or leaving or the end of the relevant retention period) to exercise options if awards are structured as nil-cost options. | Unvested awards normally lapse on leaving.

Awards for which the performance condition has been met at the time of leaving but which were subject to a retention period will continue to vest at the end of the retention period.

The Executive has 12 months from leaving, or if later, the end of the retention period to exercise vested but unexercised options (if applicable) unless the Committee determines otherwise. |

| CEO Co-Investment Award | | |

| Under the Co-Investment Plan "Good Leavers" include: Death, ill-health, disability or in any other circumstances the Committee determines. | The Committee may determine the extent to which matching shares vest either at the normal vesting date or at the time of leaving taking into account the extent to which the performance condition has been met and unless the Committee determines otherwise the period of time between award and the participant leaving.

The Executive has 12 months from vesting (or the date of leaving if later) to exercise matching shares. | Unvested Matching Shares normally lapse on leaving.

The Executive has 12 months to exercise any Matching Shares that have vested at cessation of their employment. |

| Deferred Bonus Plan ("DBP") | | |

| Under the Deferred Bonus Plan "Good Leavers" include: Death, injury, ill-health disability, redundancy, retirement, sale of the individual's employing business or company out of the Group or to a company which is not associated with the Company or in any other circumstances the Committee determines. | Outstanding awards vest on leaving.

The Executive has 6 months from leaving to exercise options (12 months in the case of death). | Awards will normally lapse unless the Committee determines that awards may be exercised. The Committee has discretion to determine the proportion of the award that shall vest and the period of time during which it may be exercised. |

The leavers' treatment under the Halfords Sharesave Scheme is determined in accordance with HMRC provisions.

In the event of an individual's misconduct all outstanding share awards would generally be forfeited.

Change of control

In the event of a change of control of the Company, PSP awards may vest (pro-rated for time elapsed in the performance period unless the Committee determines otherwise) to the extent that the Committee determines the performance condition should be deemed satisfied having regarding to the Company's progress towards that condition. The Committee may allow awards to vest on the same basis in the event of a voluntary winding up or reconstruction of the company or a demerger except that in the event of a demerger [or reconstruction] the Committee may determine the extent to which awards shall be time pro-rated.

In the event of a change of control, the co-investment award may vest to the extent the Committee determines, taking into account the extent to which the performance conditions have been met and, unless the Committee determines otherwise, the period of time between grant and the relevant event and such other relevant factors (such as the performance of the Company) as the Committee considers appropriate. The Committee may determine that awards should vest on the same basis in the event of a winding-up of the Company or if the Company is affected by a demerger, de-listing, special dividend or other event which may in the Committee's opinion affect the value of awards.

DBP awards may vest on a change of control, winding up or demerger of the Company.

Alternatively awards may be rolled over into equivalent awards in a different company.

Key elements of non-executive remuneration policy

| Purpose and link to strategy | Operation | Maximum Opportunity | Performance Measures |

|---|

| Chairman and Non-Executive Directors | To attract and retain high-calibre individuals to serve as Non-Executive Directors. | Fee levels are set to reflect the time, commitment and experience of the Chairman and the Non-Executive Directors and taking into account fee levels at other companies of a similar size and complexity and to other UK listed retailers.

The fees of Non-Executive Directors shall normally be reviewed every two years to ensure that they are in line with market conditions and any changes to said fees will be approved by the Board as a whole following a recommendation from the Chief Executive.

Fees for the Company Chairman shall normally be reviewed every two years to ensure that they are in line with market conditions and any changes to said fees will be approved by the Board as a whole.

The fees are normally paid in cash quarterly but may be paid in shares if this is considered appropriate.

The Chairman is paid a single fee which includes his chairmanship of the Nomination Committee.

The Non-Executive Directors are paid a base fee plus additional fees for their chairmanship of a Board Committee and for the role of the Senior Independent Director.

Further additional fees may be paid to reflect additional time, committee or board responsibilities if this is considered appropriate.

The Company reimburses reasonable travel and subsistence costs.

The Chairman and Non-Executive directors do not currently receive other benefits but reasonable benefits may be provided in the future if appropriate. | Overall fees paid to Directors will remain within the limit stated in the Company's Articles of Association, currently £600,000.

Non-Executive Directors and the Chairman are not entitled to participate in any cash or share incentive schemes. | None |

Appointment

None of the Non-Executive Directors has an employment contract with the Company. However, each has entered into a letter of appointment with the Company confirming their appointment for a period of three years, unless terminated by either party giving the other not less than three months' notice or by the Company on payment of fees in lieu of notice.

The remuneration package for a newly appointed Non-Executive Director would normally be in line with the structure set out in the policy table for Non-Executive Directors above.

The appointment period for each Non-Executive Director is set out below:

| Director | Date of Appointment | Date of Current Appointment | Date of resignation | Expiry Date | Unexpired term at the

date of this Report |

|---|

| Dennis Millard | 28 May 2009 | 29 May 2012 | — | 29 May 2015 | 12 months |

| Bill Ronald | 17 May 2004 | 27 July 2013 | — | 26 July 2016 | 26 months |

| David Adams | 1 March 2011 | 1 March 2014 | — | 28 February 2017 | 32 months |

| Claudia Arney | 25 January 2011 | 25 January 2014 | — | 24 January 2017 | 31 months |

| Keith Harris | 17 May 2004 | 27 July 2013 | — | 26 July 2016 | 26 months |

| Helen Jones | 1 March 2014 | 1 March 2014 | — | 28 February 2017 | 32 months |

Their appointments are subject to the provisions of the Companies Act 1985 and 2006 and the Company's Articles of Association and in particular the need for re-election. Continuation of an individual Non-Executive Director's appointment is also contingent on that Non-Executive Director's satisfactory performance, which is evaluated annually by the Chairman. The Chairman is evaluated by the Senior Independent Director.

The Non-Executive Directors' letters of appointment are available for inspection by shareholders at the Company's registered offices.

Termination of non-executive directors' letters of appointment

No compensation would be payable to a Non-Executive Director if his or her engagement were terminated as a result of him or her retiring by rotation at an Annual General Meeting, not being elected or re-elected at an Annual General Meeting or otherwise ceasing to hold office under the provisions of the Articles of Association of the Company. There are no provisions for compensation being payable upon early termination of the appointment of a Non-Executive Director.

Dialogue with shareholders

The views of our shareholders are very important to the Committee and it is our policy to consult with our largest shareholders in advance of making any material changes to the executive remuneration arrangements.

In 2013 the Committee consulted with shareholders regarding changing the performance measures for the PSP from TSR and EPS to Revenue and EBITDA with a net debt underpin. The Committee found the consultation constructive and the feedback from shareholders resulted in a change in the ratio of Revenue and EBITDA and the introduction of a retention period of two years for shares that vest by virtue of employing the performance multiplier.

Dialogue with employees

The Committee generally considers pay and employment conditions elsewhere in the Group when considering pay for Executive Directors and senior management. When considering base salary increases, the Committee reviews overall levels of base pay increases offered to other employees in the Group.

The Committee does not consult directly with employees regarding Executive Directors' remuneration. However, at regular intervals the Company conducts a survey of the views of employees in respect of their experience of working at Halfords including their own reward.

Bright and engaging product brands.