Chairman's introduction

The effectiveness of the Board is underpinned by clear corporate governance arrangements for the Group. The Board is collectively responsible for upholding high standards of corporate governance. This period, this has been reflected in the implementation of an updated delegated authorities framework as described in this report. This framework seeks to embed procedures and processes throughout the Group for the approval of financial commitments, contracts and other day-to-day and non-business-as-usual activities of the business. Additionally, the "tone from the top" has been set with regard, for example, anti-bribery and corruption and whistleblowing arrangements.

The Board works with the Executive Directors to provide advice and independent challenge to develop and deliver the long-term strategy of the Group.

Each year the Board is evaluated to uncover any issues, and confirm that the Board maintains the right composition to undertake its duties. More information on this period's internal evaluation exercise can be found in the Corporate Governance Report. It concluded amongst other things that our Board continues to maintain the right balance of skills, experience and knowledge to be able to serve the Company and its shareholders effectively.

Dennis Millard

Chairman

21 May 2014

Statement of compliance with uk corporate governance code

The UK Corporate Governance Code published by the Financial Reporting Council in September 2012 (the "Code") applies to the Company and is available on the FRC website at www.frc.org.uk. The Listing Rules have yet to be updated by the Financial Conduct Authority and continue to require that certain compliance statements are made in relation to the predecessor edition of the Code, issued in June 2010. The Board confirms that for the period ended 28 March 2014 it complied fully with the requirements of both editions of the UK Corporate Governance Code, where relevant, except in relation to the ongoing service until 31 May 2014 of Keith Harris and Bill Ronald as explained in the Corporate Governance Report.

This report outlines how we have complied with the five Main Principles of both editions of the Code, where relevant.

Leadership

Details of the Group's business model and strategy can be found in the Business Model and in the Strategy.

Leadership: role of the board

The Board is collectively responsible for ensuring that the business acts in the best interests of the Company to generate sustainable value for shareholders, whilst preserving the interests of its customers, employees and other stakeholders. The main facets of this responsibility comprise: consideration of the long-term direction and strategy of the Company; the values and standards within the business; management performance; resources; and controls. To effectively discharge these responsibilities, the Board has implemented the system of delegated authorities set out below, which enables the day-to-day operation of the business, and ensures that significant matters are brought to the attention of management and the Board as appropriate.

Board

Matters Reserved for the Board include: Strategy and Management; Structure and Capital; Investor Relations; Audit, Financial Reporting and Controls; Nominations to the Board; Executive Remuneration and Significant Contracts.

Available at: www.halfordscompany.com/i/g/mrftb

Executive Directors and Senior Managment

How We Do Business is the internal name of the formal delegated authorities document approved by the Board. It describes how day-to-day decisions are delegated to the Executive Directors, the Senior Management Team and others within the business. Each potential activity is set out by reference from whom approval must be sought and what paperwork is required as confirmation of that approval. Where an activity is not expressly described within How We Do Business, approval must be sought from the Senior Management Team who will apply the principles of How We Do Business to the decision. Training sessions were held for all relevant Support Centre colleagues on How We Do Business after it was launched with refresher courses planned yearly. The implementation of the document is constantly monitored, with an updated document to be circulated on a yearly basis.

It is through the above system of delegated authorities, that the Board is able to provide oversight and direction to the Executive Directors, Senior Management Team and the wider business.

Read more about: Internal Controls

Board composition and meeting attendance

The Board meets regularly both at the Company's Support Centre (head office), and at its store, autocentre and distribution centre locations. This provides regular opportunities for the Board to engage with, and understand, the business so as to better inform and influence their decision-making.

| | | Meeting Attendance

* indicates attendance of whole or part of the meeting by invitation |

|---|

| Role | Date of

Appointment | Board | Audit

Committee | Remuneration

Committee | Nomination

Committee |

|---|

| Board Member | | | Scheduled: 11 | Scheduled: 3 | Scheduled:

6 | Scheduled: 2 |

|---|

| Dennis Millard | Chairman and Chair of Nomination Committee | 28 May 2009 | 11/11 | 3/3* | 6/6 | 2/2 |

| Matt Davies | Chief Executive | 4 October 2012 | 11/11 | 3/3* | 4/6* | 2/2 |

| Andrew Findlay | Chief Financial Officer | 1 February 2011 | 11/11 | 3/3* | n/a | n/a |

| Bill Ronald | Non-Executive Director1 | 17 May 2004 | 9/11 | 1/3 | 6/6 | 2/2 |

| David Adams | Senior Independent Director and Chair of Audit Committee2 | 1 March 2011 | 11/11 | 3/3 | 6/6 | 2/2 |

| Claudia Arney | Non-Executive Director and Chair of Remuneration Committee3 | 25 January 2011 | 11/11 | 3/3 | 6/6 | 2/2 |

| Keith Harris | Non-Executive Director4 | 17 May 2004 | 9/11 | 2/3 | 5/6 | 1/2 |

| Helen Jones | Non-Executive Director | 1 March 2014 | 1/1 | n/a | 1/1 | 1/1 |

- Bill Ronald stood down as Senior Independent Director on 1 March 2014. He will retire from the Board on 31 May 2014.

- David Adams was appointed Senior Independent Director on 1 March 2014.

- Claudia Arney was appointed Chair of the Remuneration Committee on 1 March 2014.

- Keith Harris stood down as Chair of the Remuneration Committee on 1 March 2014. He will retire from the Board on 31 May 2014.

There were 5 Disclosure Committees during the year, which approved the final versions of market announcements, and supplementary sub-committees are created as necessary. Other members of the Senior Management Team or advisors attended by invitation as appropriate throughout the year. The Board also holds additional full-day Strategy meetings at least once a year.

At each Board meeting, the Chief Executive delivers a high level update on business, before the Board moves to considering specific reports reviewing business and financial performance, key initiatives, risk and governance. In addition, throughout the year the Senior Management Team and other colleagues deliver presentations to the Board on proposed initiatives and progress on projects.

A fun place to work means a better environment for our customers.

Chairman and chief executive

Throughout the period under review, the role of Chairman, held by Dennis Millard, and Chief Executive, held by Matt Davies, have been separate in compliance with the Code. A clear division of responsibilities exists between these roles, and is formally documented.

Available at: www.halfordscompany.com/investors/governance/division-of-responsibilities-between-the-chairman-and-chief-executive-officer

Non-executive directors

The role of the Non-Executive Directors is to provide independent thought and challenge to the Board. Specifically this involves:

- evaluating and appraising the performance of Executive Directors and Senior Management against agreed targets;

- participating in developing the strategy of the Group;

- monitoring the financial information, risk management and controls processes of the Group to make sure they are sufficiently robust;

- meeting regularly with senior management;

- periodic visits to stores, autocentres and distribution centres;

- meeting together regularly without the Executive Directors present; and

- formulating Executive Director remuneration and succession planning.

The Non-Executive Directors meet from time to time without the Executive Directors, sometimes with and without the Chairman present. The Non-Executive Directors will continue to hold similar meetings as and when required.

The Non-Executive Directors are David Adams, Keith Harris, Bill Ronald, Claudia Arney and Helen Jones. Helen Jones was appointed on 1 March 2014. Keith Harris and Bill Ronald will retire on 31 May 2014.

Senior independent director

The role of the Senior Independent Director is to:

- hold meetings with the other Non-Executive Directors without the Chairman at least once a year to appraise the Chairman's performance;

- act as an intermediary for the other Directors or a sounding board for the Chairman if required; and

- if direct contact with the Chairman, Chief Executive or other Executive Directors has not alleviated shareholder concerns, or if such direct contact would not be appropriate, be contacted by shareholders.

Bill Ronald was Senior Independent Director until he stood down on 1 March 2014 when David Adams was appointed Senior Independent Director.

Concerns

The Chairman seeks to resolve any concerns raised within or outside meetings by the Board. However, any unresolved business can be recorded on behalf of a Director in the minutes of the relevant meeting. A resigning Non-Executive Director would also able to raise any concerns in a written letter to the Chairman who would bring such concerns to the attention of the Board. No such concerns have been raised throughout the period.

Insurance

Appropriate Directors' Liability Insurance is in place.

Effectiveness

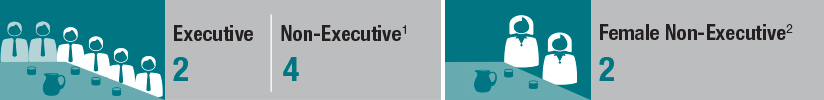

Effectiveness: Composition of the Board

The composition of the Board is as set in the Corporate Governance Report and the biographies, including other business commitments, of individual Directors are available in the Board of Directors.

Available at: www.halfordscompany.com/investors/governance/the-board

The Directors together act in the best interests of the Company via the Board and its Committees, and devote sufficient time and consideration as is necessary to fulfil their duties. Each Director brings different skills, experience, and knowledge to the Company, and the Non-Executive Directors additionally bring independent thought and judgement. This combination seeks to ensure that no individual or group restricts or controls decision-making unduly.

Skills and experience

As at 28 March 2014.

Independence

As at the date of this report, both Keith Harris and Bill Ronald will have served for over nine years as Non-Executive Directors of the Company. The Code requires the Board to determine whether independence is affected by service of more than nine years from the date of first election of each individual. The Board previously confirmed in the Annual Report 2013 that both Keith Harris and Bill Ronald were still considered to be independent in character and judgement and confirms this belief continues through to 31 May 2014 when both Keith Harris and Bill Ronald will retire as Non-Executive Directors of the Company. Therefore, neither Keith Harris nor Bill Ronald will offer themselves for re-election at the AGM.

In respect of the other Non-Executive Directors, the Board considers David Adams, Claudia Arney and Helen Jones to be independent in character and judgement in accordance with the requirements of the Code. The Chairman, Dennis Millard, was considered independent on his appointment.

In compliance with the requirements of the Code for at least half of the Board, excluding the Chairman, to be independent, the Company confirms that 62.5% of its Board are independent. From the 31 May 2014, when Keith Harris and Bill Ronald step down from the Board 50% of the Board will be independent.

Diversity

The Board considers that it is the background and experience brought to the Board by each individual that best secures and demonstrates its diversity. The principle that candidates are considered "on merit and against objective criteria, and with due regard for the benefits of diversity on the Board, including gender" is established in the Terms of Reference of the Nomination Committee1. No fixed quota is applied to decisions regarding any recruitment, rather the Nomination Committee considers capability and capacity to commit the necessary time to the role, in its recommendations to the Board. The intention is the appointment of the most suitably-qualified candidate to compliment and balance the current skills, knowledge and experience on the Board who will be best able to help lead the Company in its long-term strategy.

- Available at: www.halfordscompany.com/investors/governance/our-committees/nomination-committee.

The Board is well placed by the mixture of skills, experience and knowledge of its Directors to act in the best interests of the Company and its shareholders.

Read more about: Diversity in the Sustainability and Corporate Governance Report

- Bill Ronald and Keith Harris will retire on 31 May 2014.

- Helen Jones was appointed on 1 March 2014.

Appointments to the board

Helen Jones joined the Company as Non-Executive Director on 1 March 2014. Egon Zehnder International were engaged by the Company to conduct the search for suitable candidates and short-listed several candidates who met individually with members of the Board. Feedback from these one-to-one meetings was fed back to the Chairman. The Nomination Committee subsequently met to discuss the potential appointment and after considering the existing balance of skills, knowledge and experience on the Board, the merit and capabilities of the candidates and the time they were able to devote to the role in order to promote the success of the Company, recommended the appointment of Helen Jones to the Board.

Induction and development

An induction programme is maintained for new Directors, which is tailored to include briefings on the activities of the Group and visits to operational sites. Helen Jones is currently undertaking a full induction programme as prepared by the Chairman, with the assistance of the Company Secretary. She was provided with background materials covering the operational and organisational structure of the business, as well as the strategic aims and key initiatives of the Company when she joined. Over the next few months, she will undertake extensive store, autocentres and distribution centre visits and on-site discussions with store, autocentre and distribution centre colleagues as well as one-to-one meetings with the Senior Management Team. All current Directors have various opportunities for ongoing development and support via:

- a programme of head office, distribution centre and store/autocentre visits;

- reviews with the Chairman to identify any training and development needs;

- advice on governance, relevant legislative changes affecting the business or their duties as directors from the Company Secretary;

- membership of the Deloitte Academy, a training and guidance resource for boards and directors; and

- access to independent professional advice at the Company's expense1.

- No such advice has been sought throughout the period as far as the Company Secretary is aware.

Knowledge of the company

- Keith Harris and Bill Ronald will retire on 31 May 2014.

Evaluation

Last year an external board evaluation exercise took place involving face-to-face interviews which was conducted using an external facilitator Egon Zehnder, who had previously worked with the Company on an executive recruitment project.

This year, an internal survey was used where questions were devised by the Company Secretary and agreed with the Chairman. A web-based solution was used to deliver the survey to all Board members. The survey considered topics under the headings:

- Leading the Business — Strategy, Performance, and Talent;

- Board Dynamics & Behaviour;

- Board Composition; and

- Board Process.

Following this review, a summary of the results of the evaluation was prepared and shared with all members of the Board. The main outcomes of the evaluation this period were to acknowledge the Board's understanding of the Group's Getting into Gear strategy and any key business and strategy risks, and their management and mitigation. The survey also acknowledged that that that there is an appropriate balance of skills, experience, independence, diversity (including gender) and knowledge of the Company to enable the Directors to discharge their respective duties and responsibilities effectively.

There has been a focus during the period on the ensuring the quality of information being sent and presented to the Board so as to optimise its time and effectiveness. In the coming period, technological improvements are being considered to optimise the interface between the Board and management and further improve the efficiency of the Board's operation.

Re-election

In compliance with the Code and the Company's Articles of Association, all Directors on the Board as at 28 March 2014, except for Keith Harris and Bill Ronald, will seek re-election at the Company's AGM. Keith Harris and Bill Ronald will retire on 31 May 2014. Helen Jones who was appointed to the Board on 1 March 2014 will offer herself for election at the AGM.

Directors and their other interests

Each Director has notified the Company of any situation in which he or she has, or can have, a direct or indirect interest that conflicts, or possibly may conflict, with the interests of the Company (a situational conflict). The Board considered and approved these interests in accordance with the Company's Articles of Association and each Director was informed of the authorisation and the terms on which it was given.

All Directors are aware of the need to consult with the Company Secretary regarding any further possible situational conflict that may arise so that prior consideration can be given by the Board as to whether or not such conflict will be approved.

Details of the Directors' service contracts, emoluments, the interests of the Directors and their immediate families in the share capital of the Company and options to subscribe for shares in the Company are shown in the Directors' Remuneration Report.

Board committees

Some of the Board's responsibilities are discharged via Nomination, Audit and Remuneration Committees. The activities of these Committees are described in the Nomination Committee below. The Company Secretary also acts as the secretary to each Committee. Whilst not entitled to attend, other Directors, professional advisors and senior management attend when invited to. The auditor attends certain Audit Committee meetings by invitation. No member is present at Nomination and Remuneration Committee discussions pertinent to them.

A Disclosure Committee, made up of a minimum of two Directors, approves the final wording of market announcements prior to release.

The day-to-day treasury needs of the Group are managed by the Treasury Committee chaired by the Finance Director and whose other members are senior members of the Finance and Treasury teams.

The Board may establish other ad hoc committes of the Board to consider specific issues.

Nomination committee

Nomination committee chairman's letter

The Group's overall approach to diversity is that we aim to reflect the communities that we serve. In FY15, the Company has committed to put in place plans for improving gender diversity as an important step in achieving this goal. The Company does not currently publish specific diversity targets, but is aiming to create a more balanced workforce over the next three years, in particular on a gender basis. In achieving this goal, the focus is on improving our ability to attract a more balanced candidate pool, ensuring our recruitment processes are also appropriate and building more confidence, capability and gender diversity awareness through our development and career programmes. The Nomination Committee and the Board will continue to review progress against this area on a regular basis.

David Adams

Nomination Committee Chairman

21 May 2014

- Keith Harris will retire on 31 May 2014.

- Bill Ronald will retire on 31 May 2014.

- On joining the Board on 1 March 2014, Helen Jones also became a member of the Nomination Committee.

Except for Matt Davies, all members of the Nomination Committee are considered independent. The test of independence is not appropriate for Dennis Millard as the Chairman of the Group following his appointment to the Board as stated in the Code. The Board feels it is appropriate that Dennis Millard chairs the Committee as all Non-Executive Directors sit on the Committee. Senior members of management and advisors are invited to attend meetings as appropriate.

Principal Activities

The responsibilities of the Nomination Committee are set out in its Terms of Reference4 and in summary are making appropriate recommendations to maintain the appropriate balance of skills and experience on the Board by considering:

- the size, structure and composition of the Board; and

- senior management succession plans, retirements and appointments of additional and replacement Directors.

More information on the Group's diversity policy can be found in the Sustainability section and Corporate Governance Report.

- Available at: www.halfordscompany.com/investors/governance/our-committees/nomination-committee

| Standing Items | One-Off Considerations |

|---|

| November 2013 | |

| NED Succession | |

| CEO Management Team | |

| March 2014 | |

| Re-election of Directors | Ratification of Non-Executive Director Appointment |

| Board Committees' Memberships | Ratification of Senior Independent Director Appointment |

| AGM Attendance | |

Accountability

It is the role of the Audit Committee to ensure full stakeholder confidence in the financial matters of the business.

Audit committee

Audit committee chairman's letter

Please see the Introduction to the Audit Committee report

- Keith Harris will retire on 31 May 2014.

- Bill Ronald will retire on 31 May 2014.

- On joining the Board on 1 March 2014, Helen Jones also became a member of the Audit Committee.

Principal activities

Please see the Principal Activities section in the Audit Committee report.

Internal control and risk management

Overall responsibility for the system of internal control, reviewing its effectiveness and ensuring that there is a process to identify, evaluate and manage any significant risks that may affect the achievement of the Group's strategic objectives lies with the Board.

The Board and the Audit Committee have reviewed the effectiveness of the Group's risk management and internal control systems in accordance with the Code for the period ended 28 March 2014, and up to the date of approving the Annual Report and Financial Statements. The risk management and internal control system is designed to manage, rather than eliminate, the risk of failing to achieve business objectives and can provide only reasonable, and not absolute, assurance against material misstatement or loss.

The assessment and control of risk are considered by the Board to be fundamental to achieving corporate objectives. An ongoing process for identifying, evaluating and managing the significant risks faced by the Group and assessing the effectiveness of related controls has been established by the Board to ensure an acceptable risk/reward profile across the Group. The process has been in place throughout the period ended 28 March 2014, and up to the date of approving the Annual Report and Financial Statements. The key elements of this process which cover both the Retail and Autocentres businesses are:

- a comprehensive system of monthly reporting from key executives, identifying performance against budget, analysis of variances, major business issues, key performance indicators and regular forecasting;

- well-defined policies governing appraisal and approval of capital expenditure and treasury operations;

- reviews of key business risks (e.g. 'cyber threat' which was the subject of an Audit Committee presentation by KPMG in January 2014, with a subsequent follow-up report by internal audit) and of management's controls and plans to mitigate these risks;

- regular meetings to identify and discuss key risks and mitigations with a broad sample of the Senior Management Team and the Executive Directors;

- review of the corporate risk register in terms of completeness and accuracy with the Senior Management Team and the Executive Directors; and

- Audit Committee discussion of the corporate risk register and the risk management system with subsequent reports to the Board.

Our process for identifying, evaluating and managing the significant risks faced by the Group and assessing the effectiveness of related controls routinely identifies areas for improvement, but the Board has neither identified nor been advised of any failings or weaknesses which it has determined to be material or significant.

We are pleased to report that following a rigorous review process by HMRC, we have been categorised as a low risk tax business.

The Board considered its appetite for risk in relation to the top 30 risks determining that the risks and mitigating actions were appropriate to the level of risk that was both acceptable to, and incumbent within, a FTSE 250 business. More information on the Company's key risks and uncertainties is shown in the Risks and Uncertainties section.

Remuneration

Remuneration committee chairman's letter

Please see the Remuneration Committee Chairman's Letter.

- Claudia Arney was appointed Chair of the Remuneration Committee on 1 March 2014, when Keith Harris stood down from the role.

- Keith Harris stood down from the role of Chair of the Remuneration Committee on 1 March 2014 and will retire from the Board on 31 May 2014.

- Bill Ronald will retire from the Board on 31 May 2014.

- On joining the Board on 1 March 2014, Helen Jones also became a member of the Remuneration Committee.

Principal activities

Please see the Committee Activity section of the Annual Remuneration Report.

Relations with shareholders

During the period and until 1 March 2014 Bill Ronald served as Senior Independent Director when he stood down and David Adams was appointed Senior Independent Director. The Senior Independent Director relationship with shareholders is described in the Corporate Governance Report.

During the period under review the Chief Executive, Chief Financial Officer and Chairman have met with analysts and institutional shareholders to keep them informed of significant developments and report to the Board accordingly on the views of these stakeholders. The Investor Relations officer also conducted a number of market meetings during the year, in and outside of the UK. A separate site visit in the year was well attended by analysts and shareholders. Each of the other Non-Executive Directors was also offered the opportunity to attend meetings with major shareholders and would do so if requested by any major shareholder.

The Company's investor relations programme includes formal presentations of full year and interim results and meetings with individual investors as appropriate. Feedback from these meetings and events is provided to the Board. The Company Secretary also brings to the attention of the Board any material matters of concern raised by the Company's shareholders, including private investors.

The Interim Report and the Annual Report and Financial Statements are the primary means of communication during the year with all of the Company's shareholders. The Board recognises the importance of the web as a means of communicating widely, quickly and cost-effectively and an Investor Relations website www.halfordscompany.com/investors facilitates communication with shareholders. Information available online includes copies of the full and half-year financial statements, market announcements, corporate governance information, the Terms of Reference for the Audit, Nomination and Remuneration Committees and the Matters Reserved for the Board. The Company's financial calendar and other shareholder information, which are also available online, are set out in the Company Information.

The Board welcomes the opportunity to meet with shareholders and to hear their views and answer their questions about the Group and its business at the Company's AGM which will be held on Tuesday, 29 July 2014 at the Hilton Garden Inn, 1 Brunswick Squre, Brindley Place, Birmingham B1 2HW. The Chairs of the Remuneration, Nomination and Audit Committees will be present at the AGM and will be in a position to answer questions relevant to the work of those Committees. It is the Company's practice to propose separate resolutions on each substantial issue at the AGM. The Chairman will advise shareholders on the proxy voting details at the meeting.

By order of the Board

Alex Henderson

Group Company Secretary

21 May 2014