Committee activity

The committee

During the year and the period to the date of this report the Remuneration Committee (the "Committee") consisted of Keith Harris; Dennis Millard; Bill Ronald; David Adams; and Claudia Arney. Claudia Arney took over the Chairmanship of the Committee from Keith Harris on 1 March 2014. In this time the Committee has:

- Discussed and approved both financial and strategic annual bonus metrics and targets;

- Reviewed and set the salaries of the CEO and FD with effect from 1 October 2013;

- Reviewed and commented on the salaries and incentive arrangements for the executive management;

- Reviewed and approved the salaries and incentives arrangements for the recruitment of senior executives;

- Held discussions with shareholders and approved changes to the performance conditions for awards made under the Performance Share Plan from 2013 onwards;

- Measured the performance conditions of the Company Share Option Scheme (which operates for Senior Executives below Board level) and the Performance Share Plan awards granted in 2010, confirming that neither of the Schemes' performance condition targets had been met;

- Approved grants under the Performance Share Plan, Company Share Option Scheme (to Senior Executives below Board level) and Sharesave Scheme;

- Approved amendments to the rules of the Company Share Option Scheme and the Sharesave Scheme in respect of Finance Act 2013 changes;

- Approved new rules for the Company Share Option Scheme and the Sharesave Scheme to be put before shareholders at the 2014 Company's Annual General Meeting (the old plans having expired this year);

- Reviewed and approved the Company's Remuneration Policy and Annual Remuneration Report for placing before shareholders at the Company's Annual General Meeting on 29 July 2014;

- Undertaken a review of Committee effectiveness and agreed steps to enhance effectiveness; and

- Considered and approved the Committee's terms of reference.

Advisors

During the year the Committee has been supported by Jonathan Crookall, People Director and Alex Henderson, Company Secretary. The CEO and CFO may also on occasion attend Committee meetings on the request of the Committee but are not present when their own remuneration is discussed. The Committee also engaged with Deloitte LLP, who has advised on performance measures for the PSP, remuneration reporting and other remuneration matters. Fees paid to Deloitte for this advice were £5,900. Deloitte have also provided advice to management as part of their support to the Committee, primarily in relation to remuneration reporting. A separate team within Deloitte has also provided debt advisory advice.

Deloitte are founding members of the Remuneration Consultants Group and adhere to the Remuneration Consultants Group Code of Conduct when dealing with the Committee. The Committee considers their advice to be independent and impartial. The Committee is also satisfied that the Deloitte LLP engagement partner and team, which provided remuneration advice to the Committee, do not have connections with Halfords that might impair their independence. The Committee reviewed the potential for conflicts of interest and judged that there were appropriate safeguards against such conflicts.

Towers Watson also provided the Committee with executive salary benchmark data. Towers Watson are also signatories of the Remuneration Consultants Code of Conduct. Fees paid to Towers Watson for this advice were £3,500.

Fees for both Deloitte and Towers Watson were charged on a time and materials basis.

Shareholder dialogue

The Committee is committed to ongoing shareholder dialogue and carefully reviews voting outcomes on remuneration matters. In the event of a substantial vote against a resolution in relation to Directors' remuneration, Halfords would seek to understand the reasons for any such vote, determine appropriate actions and would detail any such actions in response to it in the Directors' Remuneration Report.

The following table sets out actual voting in respect of our last report in 2013:

| % of votes | For | Against |

|---|

| For 2012/13 Directors' Remuneration Report (2013 AGM) | 88.8% | 11.2% |

6,247,647 votes were withheld in relation to this resolution (c.4% of shareholders).

How was the remuneration policy implemented in 2013/14 — executive directors

Single remuneration figure for 2013/14 (audited)

| Base

Salary | Bonus

(due in

respect of

2013/14)1 | Benefits | Pension | PSP

(due in

respect

of perform-

ance

period

ended

2013/14)2 | Total

'Single

Figure'

2014 |

|---|

| Matt Davies | 503,750 | 736,734 | 31,212 | 100,375 | n/a | 1,372,071 |

| Andrew Findlay | 302,750 | 295,181 | 17,050 | 45,000 | — | 660,011 |

| Totals | 806,500 | 1,031,915 | 48,262 | 142,250 | 0 | 2,028,957 |

- The calculation of the bonus payable in respect of the period ended 28 March 2014 is given in the Annual Remuneration Report.

- Shares were awarded in August 2011 under the Performance Share Plan based on performance in the period April 2011 to March 2014. In May 2014 the performance conditions for these shares were measured and the Committee determined that awards would not vest. Further detail is given in the Annual Remuneration Report. Matt Davies did not receive a PSP award in 2011 as this was prior to him joining the Company.

Single remuneration figure for 2012/13 (audited)

| Base

Salary | Bonus

(due in

respect of

2012/13) | Benefits | Pension | PSP

(due in

respect

of perform-

ance

period

ended

2012/13) | Total

'Single

Figure'

2013 |

|---|

| Matt Davies3 | 246,795 | 187,500 | 14,318 | 50,000 | n/a | 498,613 |

| Andrew Findlay | 280,500 | 56,100 | 16,335 | 41,250 | — | 394,185 |

| Totals | 527,295 | 243,600 | 30,653 | 91,250 | — | 892,798 |

- Matt Davies was appointed to the Board on 4 October 2012.

Salary

In keeping with its usual cycle of reviewing Company-wide salaries in September/October the Committee considered an executive pay report compiled for them by Towers Watson. The Committee concluded that the salary for the CEO was competitive and decided to increase his salary by 1.5% to £507,500 in line with the average increase awarded to colleagues across the business. In reviewing the Executive Directors' responsibilities the Committee determined that the Group's CFO, Andrew Findlay, had assumed Board responsibility for a number of additional areas of the business, most importantly that of IT. This was considered by the Board to be a vital role in the delivery of the Company's Getting Into Gear programme.

The Committee considered that Andrew Findlay's salary did not appropriately reflect the scope and responsibilities of his increased role and as such the Committee considered it appropriate that he receive an increased salary from 1 October 2013 of £325,000 (16% increase).

2013/14 Annual bonus

Annual Bonuses for 2013/14 for Executive Directors were based 75% on Group PBT and 25% on the delivery of key strategic initiatives crucial to the delivery of the Company's strategy. These initiatives included improving the retention rate of colleagues who had been with the business for three months; increasing the 'value-added' service sales; increasing the range of parts, accessories and clothing on offer in the Company's Cycling category; improving both colleague and customer engagement with the Halfords brand; and the development of new 50:39 store formats.

Annual Bonuses reported in the above table and payable in May 2014 for the financial period ended 28 March 2014 were calculated as follows.

| | Performance | | |

|---|

| Measure | Bonus

Opportunity

(% of total

award) | Threshold | Target | Stretch | Performance

delivered | Bonus

awarded

(% of total

award) |

|---|

| PBT | 75% | 92% of budget | 100% of budget | 106% of budget | Underlying PBT for year as £72.8m was in excess of 106% of target and therefore this proportion of the annual bonus is payable in full. | 75.0% |

| The Remuneration Committee has discretion to determine the extent to which these initiatives have been achieved. In determining the outcome in relation to each initiative the Committee considered the following achievements: |

| — Retention of Store Colleagues; | Reducing the number of colleagues who leave the business, as a percentage, within three months of their start date. | Achieved | 5% |

| — Value Added Sales; | Increasing the total incremental sales in the financial year of 3Bs fitting, other auto fitting, cycle repair, Sat Nav attachment and cycle accessories. | The initiatives included in this

project led to sales increasing

in a range in the lower half

of the target. | 2.5% |

| — Net Promoter Score Formats; | As measured by the Empathica mechanism in stores – increasing the average score over the final three months of the year. | Achieved | 5% |

| — Engagement Index; | Increasing the year on year engagement index based on the annual survey. | Achieved | 5% |

| — 50:39 Store Delivery. | 15 stores refurbished and a blueprint established for roll out. | Achieved | 5% |

| | | | | Total Bonus | 97.5% |

The Committee reviewed the annual bonus payout in the context of the performance of the underlying business during the year and the delivery against strategy and determined that the level of bonus paid was appropriate in this context.

Bonus targets are considered by the Board to be commercially sensitive as they could reveal information about Halfords' business plan and budgeting process to competitors which could be damaging to Halfords' business interests and therefore to shareholders. The Committee will look to disclose targets when they are considered to no longer be commercially sensitive.

2011 Performance share plan award

Awards granted in 2011 under the PSP were subject to the following performance conditions:

| | TSR Performance Element

(50% of award) | EPS Performance Element

(50% of award) |

|---|

Award "Multiplier"

(up to 1.5 x initial award) i.e. 225% of salary. | 1.5 x initial award vesting | Upper Decile performance | 16% growth p.a. above RPI |

| Straight-line vesting | Between Upper Quartile and

Upper Decile performance | Between 11% growth p.a. and

16% growth p.a. above RPI |

Core Award

(150% of salary) | 100% Vesting | Upper Quartile performance | 11% growth p.a. above RPI |

| Straight-line vesting | Between Median and

Upper Quartile performance | Between 4% growth p.a. and

11% growth p.a. above RPI |

| 30% Vesting | Median performance | 4% growth p.a. above RPI |

| 0% Vesting | Below Median performance | Below 4% growth p.a. above RPI |

TSR and EPS performance are assessed on an independent basis. However, to ensure that the PSP continues to support sustainable performance, the multiplier for one measure is only applied if performance is at least at the threshold level for the other measure.

The companies included in the TSR comparator group are based on the FTSE 350 general retail and food retail companies on the date of grant. For awards granted in 2011 these are as follows:

Brown Group; Carpetright; Debenhams; Dignity; Dixons Retail plc (formerly DSG International); Dunelm Group; Greggs; Home Retail Group; JD Sports Fashion plc; Darty (formerly Kesa Electricals); Kingfisher International; Marks & Spencer Group; Morrison (WM); Mothercare; Next; Sainsbury (J); Sports Direct; Tesco; WH Smith.

Based on TSR performance between 2 April 2011 and 28 March 2014, Halfords' TSR was just below median against the comparator group and therefore 0% of the portion of the TSR element of the award will vest. EPS growth between FY11 and FY14 was below RPI and therefore 0% of the EPS element of the award will vest.

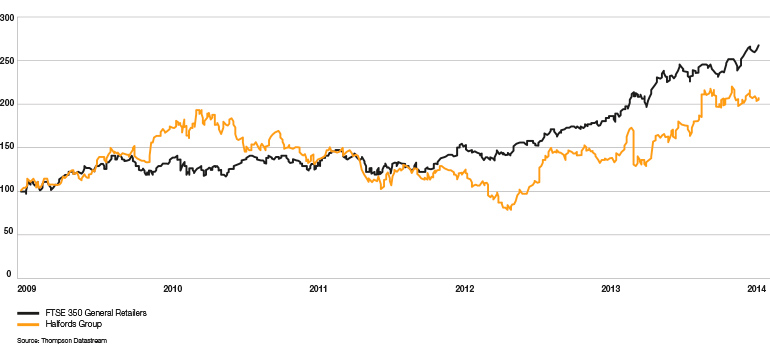

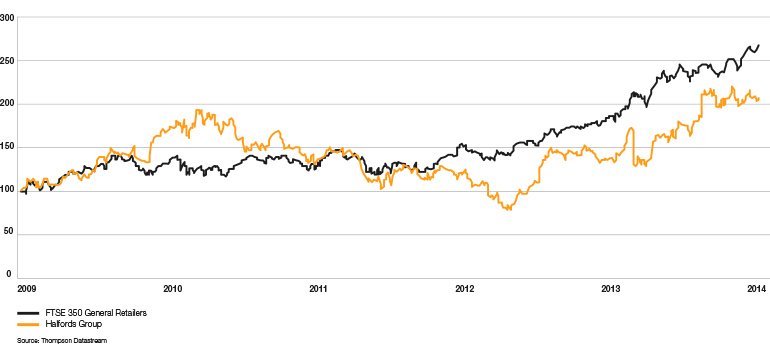

Tsr performance graph

The following graph shows the TSR performance of the Company since April 2009, against the FTSE 350 General Retailers (which was chosen because it represents a broad equity market index of which the Company is a constituent).

TSR was calculated by reference to the growth in share price, as adjusted for reinvested dividends.

The following table shows the history of PSP award vesting over the last 5 five years.

| FY10 | FY11 | FY12 | FY13 | FY14 |

|---|

| PSP vestings (% of maximum) | 100% | 99% | 0% | 0% | 0% |

Standard benefits

Standard benefits include payments made in relation to life assurance, private health insurance and the provision of a company car or equivalent cash allowance and the use of a chauffuer when appropriate.

Pension

Pension payments represent contributions made either to defined contribution pension schemes or as a cash allowance. The CEO received a contribution of 20% of base salary and the CFO received contribution of 15% of base salary.

Share awards granted during the year (audited)

Performance share plan

During the year the Committee approved awards to the Executive Directors under the Performance Share Plan as follows;

| Date of award | Type of award | Number of shares | Maximum

face value of award (1.5x the number of awards granted)** | Threshold vesting

(% of target award) | Performance

period |

|---|

| Matt Davies | 7 August 2013 | Nil cost option (0p exercise price) | 200,588* | £1,124,998 | 30% | 30 March 2013 to

25 March 2016 |

| Andrew Findlay | 112,530* | £631,125 |

* These awards were based on 150% of salary.

** Based on the mid-market price on the date of the awards of £3.739.

Performance Conditions

Awards granted in 2013 are subject to the following performance conditions:

| | Group Revenue Growth — CAGR (25% of the award) | Group EBTIDA Growth — CAGR

(75% of the award) |

|---|

Award "Multiplier"

(up to 1.5 x initial award) i.e. 225% of salary. | 1.5 x initial award vesting | 8.00% | 6.50% |

| Straight-line vesting | Between 4.75% and 8.00% | Between 3.25% and 6.50% |

Core Award

(150% of salary) | 100% Vesting | 4.75% | 3.25% |

| Straight-line vesting | Between 4.00% and 4.75% | Between 2.50% and 3.25% |

| 30% Vesting | 4.00% | 2.50% |

| 0% Vesting | Below 4.00% | Below 2.50% |

In addition to achieving these targets, the vesting of awards will be subject to meeting an underpin of net debt to EBITDA ratio no greater than 1.5x throughout the three-year performance period. This will ensure that net debt remains at appropriate levels and management is not incentivised to invest in new activities that are not profitable thereby increasing net debt levels to meet targets; the focus is to maximise the return on cash investments. The Core Award shares that vest will become exercisable in August 2016. To the extent that awards vest in line with the performance multiplier outlined above, these shares will only become exercisable in August 2018, following a retention period of two years.

Deferred Bonus Plan

Matt Davies received a bonus of £187,500 in respect of 2012/13, of which one-third (£62,500) was deferred into 18,997 shares under the Deferred Bonus Plan on 31 May 2013 at a price of £3.29 per share. These shares vest, subject to the clawback provisions referred to in the Remuneration Policy Report, on 31 May 2016.

Outstanding share awards (audited)

Performance Share Plan

The following summarises outstanding awards under the PSP:

| Award Date | Mid-

market

price on

date of

awards | Awards

held

29 March

2013 | Awarded

during the

period | Dividend

Reinvestment1 | Forfeited

during the

period | Lapsed

during the

period | Exercised

during

the year | Awards

held

28 March

2014 | Performance

period 3 years

to |

|---|

| Matt Davies | 7 August 2013 | 3.74 | — | 200,588 | 2,220 | — | — | — | 202,808 | 1 April 2016 |

| Andrew Findlay | 8 August 20112 | 3.17 | 230,692 | — | 8,275 | — | — | — | 238,967 | 28 March 2014 |

| 3 August 2012 | 2.20 | 195,866 | — | 7,026 | — | — | — | 202,892 | 3 April 2015 |

| 7 August 2013 | 3.74 | — | 112,530 | 1,246 | — | — | — | 113,776 | 1 April 2016 |

- Interim and final dividends have been reinvested in shares at prices between £3.7100 and £4.6974.

- The Remuneration Committee has reviewed the performance conditions attached to 2011 Performance Share Plan award and determined that the performance conditions have not been met. The award will therefore lapse on 8 August 2014.

The performance conditions for awards are summarised above. The performance conditions for 2012 awards are the same as for 2011 awards.

Co-Investment Plan

| Award Date | Awards held

30 March

2012 | Awarded during the period | Dividend

Reinvestment | Lapsed

during the period | Exercised during

the year | Awards held

29 March

2013 | Performance period 3–5 years |

|---|

| Matt Davies | 28 January 2013 | — | 574,1961 | 20,4702 | — | — | 594,666 | November 2015 - November 2017 |

- This award represents 3.5 times Matt Davies' initial investment of 164,056 shares purchased at a price of £3.02 on 4 October 2012.

- Interim and final dividends have been reinvested in shares at prices between £3.7100 and £4.6974.

On appointment, the Company made the CEO a one-off Co-Investment Award. This Award was designed to allow the Company to recruit and retain an executive of the calibre required to run the business and to incentivise the CEO to deliver exceptional shareholder value creation through the achievement of share price performance targets. This plan was adopted for the sole purpose of making a one-off award to the Group's new CEO. It is not anticipated that any further awards will be made under this Plan to either the Group's CEO or other executives.

Performance conditions

Under the Plan the CEO invested £500,000 into Halfords shares, acquiring 164,056 shares at 302.22p per share. The CEO was then awarded a maximum matching award of 3.5x the number of invested shares (574,196 shares). Subject to continued employment these shares may vest up to a third in November 2015, up to two thirds in November 2016 and in full in November 2017, depending on the following Threshold (30% vesting) and Maximum (100% vesting) share price performance targets of Halfords:

| November | Threshold | Maximum |

|---|

| 2015 | 350p | 400p |

| 2016 | 385p | 440p |

| 2017 | 425p | 485p |

Share price performance will be assessed using the average mid-market closing share price for the 30 days following the announcement of the Interim results for the relevant year (normally November). At each relevant vesting date the CEO may decide to either exercise any portion of the award that has vested at that time (in which case any unvested shares in that tranche in respect of which the share price target has not been met will lapse) or roll forward that tranche in full to be subject to performance testing at the next vesting date. In the latter case ("roll-forward") the CEO will forfeit the right to exercise any awards that had become capable of vesting at the earlier vesting date.

Matching shares were granted in the form of nil cost options. Vested options can be exercised until the 10th anniversary of the date of grant. Matching shares accrue additional shares related to dividends.

Prior to vesting the Committee will satisfy themselves that the achievement of the Share Price Target is a genuine reflection of the Company's underlying financial performance and may adjust the level of vesting accordingly. The Committee may determine that Matching Shares can be scaled back before exercise for circumstances such as material misstatement, the individual being responsible for serious reputational damage to the Company, or in circumstances where the Company suffers serious losses.

Halfords Group plc Deferred Bonus Plan

| Award Date | Awards held

29 March

2013 | Awarded during the period | Dividend Reinvestment | Lapsed

during the period | Exercised during

the year | Awards held

28 March

2014 |

|---|

| Matt Davies | 31 May 2013 | — | 18,9971 | 681 | — | — | 19,678 |

- Matt Davies received a bonus of £187,500 of which one-third was deferred into shares under the Halfords Deferred Bonus Plan at a price of £3.29 per share.

CEO pay compared to performance

The following tables compares the Company's TSR performance with the CEO remuneration for the past 5 years and outlines the proportion of annual bonus paid as a percentage of the maximum opportunity and the proportion of PSP awards vesting as a percentage of the maximum opportunity. The annual bonus is shown based on the year to which performance related and the PSP is shown for the last year of the performance period.

| | 2009/10 | 2010/11 | 2011/12 | 2012/13 | 2013/14 |

|---|

| CEO salary, benefits | Matt Davies1 | n/a | n/a | n/a | 311 | 635 |

| and pensions | David Wild2 | 605 | 606 | 617 | 198 | — |

| Annual bonus | Matt Davies | n/a | n/a | n/a | 50% | 97.5% |

| (% of maximum) | David Wild | 100% | 0% | 0% | n/a | n/a |

| PSP vesting | Matt Davies | n/a | n/a | n/a | n/a4 | n/a6 |

| (% of maximum) | David Wild | n/a3 | 99% | 0% | n/a5 | — |

- Matt Davies was appointed on 4 October 2012.

- David Wild stepped down as CEO on 19 July 2012.

- David Wild did not receive a PSP award in 2007 as this was before he was appointed. The 2007 PSP awards vested in full.

- Matt Davies did not receive a PSP award in 2010 as this was before he was appointed. The 2010 PSP awards lapsed in full.

- David Wild's 2010 PSP award lapsed on leaving.

- Matt Davies did not receive a PSP award in 2011 as this was before he was appointed.

Executive director shareholding (audited)

| Matt Davies | Andrew Findlay |

|---|

| Shareholding Requirement | 100% | 100% |

| Current Shareholding | 174,056 | 19,108 |

| Current Value (based on share price on 28 March 2014) | £802,572 | £88,107 |

| Current % of Salary | 158% | 27% |

| Date by which guideline should be met | 4 October 2017 | 1 February 2016 |

These figures include those of their spouse or civil partner and infant children, or stepchildren, as required by Section 822 of the Companies Act 2006. There was no change in these beneficial interests between 28 March 2014 and 22 May 2014.

Outside appointments

Halfords recognises that its Executive Directors may be invited to become Non-Executive Directors of other companies. Such non-executive duties can broaden experience and knowledge which can benefit Halfords. Subject to approval by the Board, Executive Directors are allowed to accept Non-executive appointments and retain the fees received, provided that these appointments are not likely to lead to conflicts of interest. During the year Matt Davies received fees of £41,250 as a Non-Executive Director of Dunelm Group plc.

Loss of office payments (audited)

Paul McClenaghan left the business on 12 April 2013. The Committee determined that it was appropriate to treat him as a Good Leaver and therefore allowed him to retain his PSP awards granted in 2011 and 2012 which will vest on a pro-rata basis in relation to the elapsed time of the performance period at his leaving date and subject to performance at the normal testing date. Paul McClenaghan was also paid a lump sum of £218,025, being equivalent to nine months' salary, in full and final settlement of any contractual obligations. This sum was less than the amount he was due under the termination provisions of his service agreement.

Payments to former directors (audited)

There were no payments to former directors during the year.

How was the remuneration policy implemented in 2013/2014 — non-executive directors

Non-Executive Director Single Figure Comparison (audited)

| Director | Role | Board Fees3 | Senior Independent Director1 | Committee Chairman Fees2 | Total

'Single Figure' 2014 | Total

'Single Figure' 2013 |

|---|

| Dennis Millard | Chairman | 165,916 | — | — | 165,916 | 215,000 |

| Bill Ronald | Senior Independent Director | 45,250 | 13,750 | — | 59,000 | 60,000 |

| David Adams | Audit Committee Chairman | 45,250 | 1,250 | 5,000 | 51,500 | 50,000 |

| Claudia Arney | NED | 45,250 | | 417 | 45,667 | 45,000 |

| Keith Harris | Remuneration Committee Chairman | 45,250 | — | 4,583 | 49,833 | 50,000 |

| TOTALS | | 346,000 | 15,000 | 10,000 | 371,000 | 420,000 |

- On 1 March 2014 David Adams took over from Bill Ronald as Senior Independent Director.

- On 1 March 2014 Claudia Arney took over from Keith Harris as Chairman of the Remuneration Committee.

- On 1 March 2014 the fees for Non-Executive Directors were increased from £45,000 to £48,000, and the Chairman's fees were increased from £165,000 to £176,000 see How Remuneration policy will be implemented for 2013/14 - Non executive directors

Non-Executive Director Shareholding

| Director | 2014 | 2013 |

|---|

| Dennis Millard | 50,000 | 40,000 |

| Bill Ronald | 11,538 | 11,538 |

| David Adams | 6,000 | 6,000 |

| Claudia Arney | 21,052 | 21,052 |

| Keith Harris | 3,386 | 3,386 |

| Helen Jones | — | n/a |

These figures include those of their spouses, civil partners and infant children, or stepchildren, as required by Section 822 of the Companies Act 2006. There was no change in these beneficial interests between 28 March 2014 and 22 May 2014.

Non-Executive Directors do not have a shareholding guideline but they are encouraged to buy shares in the Company.

How remuneration policy will be implemented for 2014/15 – executive directors

Salary

Base salaries were last reviewed with effect from 1 October 2013 and increases were made as per the details in the Annual Remuneration Report. Current salaries for the Executive Directors are as follows:

Salaries will next be reviewed with effect from 1 October 2014.

Annual Bonus

The annual bonus opportunity for 2014/15 will remain unchanged as follows:

| CEO | - Maximum opportunity of 150% of base salary

|

| |

| - 1/3rd paid in Halfords shares deferred for three years

|

| CFO | - Maximum opportunity of 100% of base salary

|

| |

The annual bonus for 2014/15 will be based 80% on Profit Before Tax ('PBT') performance and 20% based on performance against strategic objectives. PBT targets are calibrated with reference to prior year performance and the Group's business plan and zero payment will be made for threshold performance with maximum payment being made for a stretch target and intermediate payments being made on a straight-line basis.

The Committee reviews the goals included in the strategic objectives portion of the bonus to ensure that they remain appropriate. For 2014/15 the Committee determined that the strategic objectives would be linked to the delivery of the Company's goal of delivering growth in top line revenues. The Remuneration Committee have identified measures that it considers will measure the successful delivery of each objective and these also represent the non-financial strategic measures that will form part of the Executive Director's 2014/15 annual bonus plan.

These are detailed below:

| Measure | Definition |

|---|

| Net Promoter Score ("NPS") | Improved NPS as measured by the Empathica mechanism in store. Average score over the final 3 months of the year. |

| Engagement Scores | Improved colleague engagement scores as measured by the index achieved in the survey planned to take place in 2015. |

| Value Added Sales | Increasing the total incremental sales in the financial year of 3Bs fitting, other auto fitting, cycle repair, Sat Nav attachment and cycle accessories. |

| Delivering an effective economic model for retail stores through the 50:39 project | If the increase in the incremental sales for at least 50% of the refreshed stores collectively is in excess of 1.5% the threshold has been met, whilst ensuring that the balance of the portfolio also maintains positive growth in sales. If the incremental sales for at least 50% of the refreshed stores collectively is in excess of 3% the maximum has been met. |

| Colleague Retention | Reducing the number of colleagues who leave the business as a percentage within 3 months of their start date. |

In determining whether any bonuses are payable the Committee retains the discretionary authority to increase or decrease the bonus to ensure that the level of bonus paid is appropriate in the context of performance.

The details of bonus targets is considered by the Board to be commercially sensitive as they could reveal information about Halfords' business plan and budgeting process to competitors which could be damaging to Halfords' business interests and therefore to shareholders.

Share plans

The Company has adopted four share plans: The Halfords Sharesave Scheme; the Halfords Company Share Option Scheme ("CSOS"), a market value share option plan; the Halfords Performance Share Plan ("PSP"); and the Halfords Co-Investment Plan (it is intended that no further awards will be made under this plan). Executive Directors do not participate in the CSOS.

For the Executive Directors' the Committee intends to continue granting awards under the Performance share plan of 150% of base salary. If exceptional performance is achieved up to 1.5x the core award can be earned ('performance multiplier'). The vesting of awards will be subject to meeting the following performance conditions:

| | Group Revenue Growth —

CAGR (25% of the award) | Group EBTIDA Growth

(75% of the award) |

|---|

Award "Multiplier"

(up to 1.5 x initial award i.e. 225% of salary.) | 1.5 x initial award vesting | 7.5% | 9.0% |

| Straight-line vesting | Between 6.5% and 7.5% | Between 7.5% and 9.0% |

Core Award

(150% of salary) | 100% Vesting | 6.5% | 7.5% |

| Straight-line vesting | Between 5.0% and 6.5% | Between 5.0% and 7.5% |

| 30% Vesting | 5.0% | 5.0%% |

| 0% Vesting | Below 5.0% | Below 5.0% |

In addition to achieving these targets, the vesting of awards will be subject to meeting an underpin of net debt to EBITDA ratio no greater than 1.5x throughout the three-year performance period. This will ensure that net debt remains at appropriate levels and management is not incentivised to increase net debt levels to meet targets; the focus is to maximise the return on cash investments. The Core Award shares that vest will become exercisable in August 2017. To the extent that awards vest in line with the performance multiplier outlined above, these shares will only become exercisable in August 2019, following a retention period of two years.

While committed to the use of equity-based performance-related remuneration as a means of aligning Executive Directors' interests with those of shareholders, the Committee is aware of shareholders' concerns on dilution through the issue of new shares to satisfy such awards. Therefore, when reviewing remuneration arrangements, the Committee takes into account the effects such arrangements may have on dilution. Halfords intends to comply with the ABI guidelines relating to the issue of new shares for equity incentive plans.

Benefits

The Company will continue to provide a car plus fuel or cash allowance, private health insurance and life assurance as standard benefits.

Pensions

The Company will continue to makes contributions to the Halfords Pension Plan 2009 or make payments into a personal fund, the purpose of which is to provide additional benefits. Contribution rates will remain at 20% for the CFO and 15% for the Finance Director.

How remuneration policy will be implemented for 2013/14 – non-executive directors

Fees

The fees of Non-Executive Directors shall normally be reviewed every two years to ensure that they are in line with market norms so that the Company can attract and retain individuals of the highest calibre and any changes to said fees will be approved by the Board as a whole following a recommendation from the Chief Executive. The base fee for Non-Executive Directors was increased by 6.6% as from 1 March 2014. At the same time following a recommendation by the CEO, the Remuneration Committee approved an increase of 6.6% in the Chairman's fees. This was the first increase in these fees since April 2009. Current fees for Non-Executive Directors are as follows:

| 2014 | 2013 |

|---|

| Chairman | £176,000 | £165,000 |

| Base fee | £48,000 | £45,000 |

| Additional fees | — | — |

| Senior Independent Director | £15,000 | £15,000 |

| Committee Chairman (Audit and Remuneration) | £5,000 | £5,000 |

Spend on pay

The Committee is aware of the importance of pay across the Group in delivering the Group's strategy and of shareholders' views on executive remuneration.

Change in Remuneration of Chief Executive compared to Group Employees

The table below sets out the increase in total remuneration of the Chief Executive and that of all colleagues:

| % change in base salary FY13 to FY14 | % change in bonus earned

FY13 to FY141 | % change in benefits FY13 to FY14 |

|---|

| Chief Executive | 1.50 | 196.5% | No Change |

| All Colleagues | 1.94 | 270.2% | No Change |

- In FY13 the bonuses earned were based on the achievement of personal objectives and/or sales incentives. In FY14 the bonuses earned were based on the achievement of personal objectives and/or sales incentives and the achievement of the Group's underlying EBITDA target.

Relative Importance of Pay

The Committee is also aware of shareholders' views on remuneration and its relationship to other cash disbursements. The following table shows the relationship between the Company's financial performance, payments made to shareholders, payments made to tax authorities and expenditure on payroll.

| 2014 | 2013 |

|---|

| EBITDA | £101.1m | £103.4m |

| PBT (underlying) | £72.8m | £72.0m |

| Returned to Shareholders: | | |

| Dividend | £27.7m | £42.7m |

| Share Buyback | — | £0.9m |

| Payments to Employees: | | |

| Wages & Salaries | £173.0m | £153.5m |

| Including Directors1 | £2.0m | £1.51m |

- Based on the single figure calculation, not all of which is included within wages and salary costs.